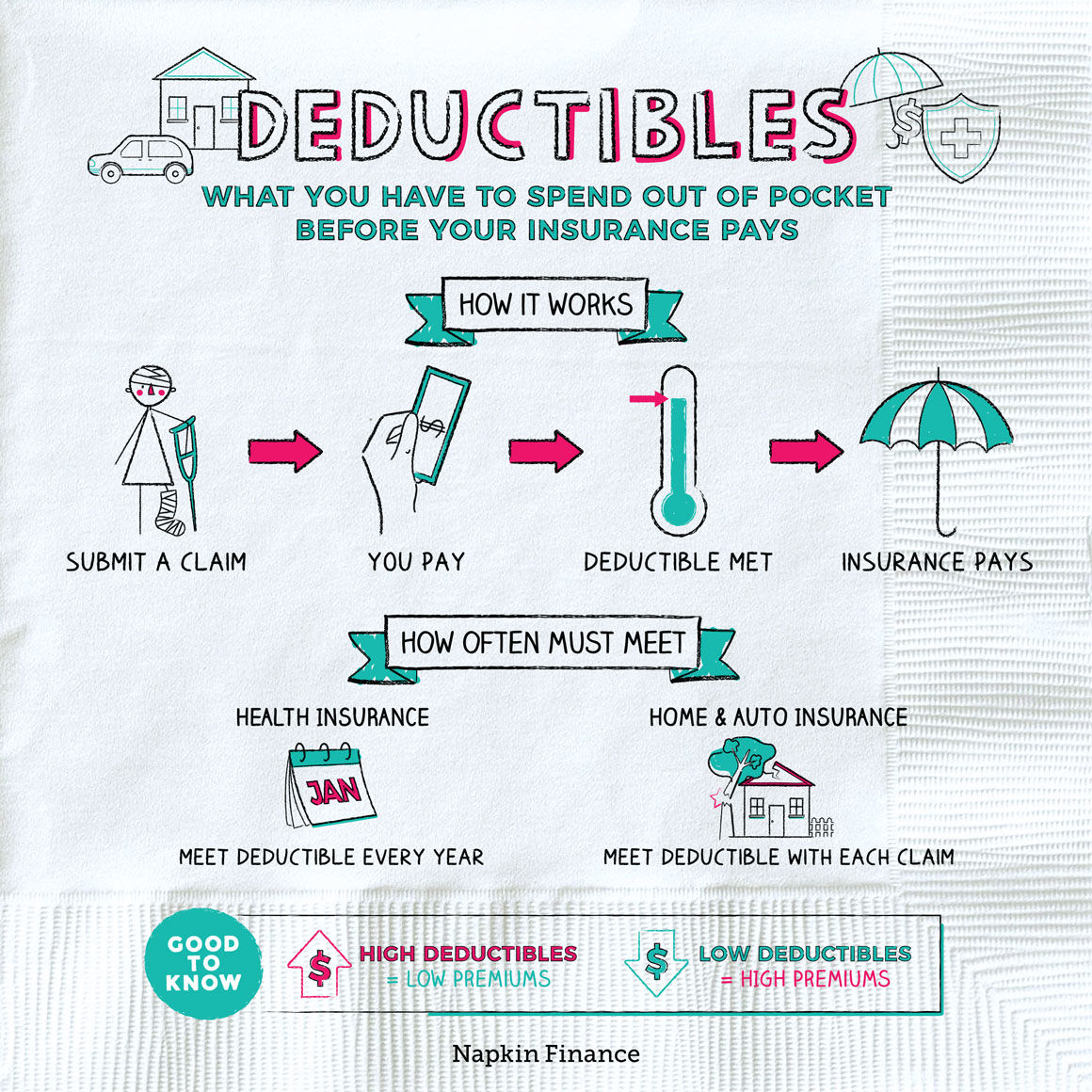

An Insurance Deductible Is Quizlet | After that, you share the cost with your plan by paying coinsurance. A deductible is a set amount you may be required to pay out of pocket before your plan begins to pay for as mentioned, the health insurance deductible may vary from plan to plan. In most cases, your insurance deductible refers to the dollar value you'll pay out of pocket before your insurance company covers the rest of the money for. The calculus for choosing your deductible is slightly different with these two insurance types than with health insurance. Typically, a home insurance policy deductible is at least $500.

Once you've met this comprehensive deductible, your plan's coinsurance will take effect. If your plan's deductible is $1,500, you'll pay 100 percent of eligible health care expenses until the bills total $1,500. What is a car insurance deductible? An insurance deductible is the amount of money you, the policy holder, have to pay for services or benefits covered by your insurance policy before your insurance for example, you may have a car insurance plan that covers damage to your car, but your policy specifies an $800 deductible per claim. Unlike auto, renters, or homeowners insurance, where you don't get services until you pay your deductible, many health insurance plans provide some benefits before you meet the deductible.

A health insurance deductible is different from other types of deductibles. Create your own flashcards or choose from millions created by other students. Insurance deductible pertains to the amount of money on an insurance claim that you would pay before the coverage kicks in and the insurerfinancial intermediarya financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. Typically, a home insurance policy deductible is at least $500. Some insurers make $1,000 the default choice, and as a result, many of their policies are written with a $1,000 deductible. Deductibles can vary depending on coverage. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. In health insurance, a deductible is the amount that you as a policyholder must pay each year toward your medical expenses before the insurance company what is a deductible in regards to insurance coverage? A deductible is your share of an insurance claim, which you must pay before your insurer provides financial coverage. After that, you share the cost with your plan by paying coinsurance. A comprehensive deductible is a deductible amount that applies to and includes all of the medical coverages in your health insurance plan. It's important to take your time to compare plans side by side, since higher. Unlike auto, renters, or homeowners insurance, where you don't get services until you pay your deductible, many health insurance plans provide some benefits before you meet the deductible.

The insurance company covered the rest of the average hdhp deductible is 2 486 but many plans exceed 3 000 according to the kaiser family foundation. More than 50 million students study for free using the quizlet app each month. In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. Some insurers make $1,000 the default choice, and as a result, many of their policies are written with a $1,000 deductible. Deductibles are created to share the cost of care.

The insurance company covered the rest of the average hdhp deductible is 2 486 but many plans exceed 3 000 according to the kaiser family foundation. Home insurance deductibles are usually quite different than other insurance deductibles. A deductible is an amount of money that you yourself are responsible for paying toward an insured loss. The insurance deductible is the amount your claim must meet before your insurance company will pay anything toward the claim. Depending on the insurance plan, the deductible can range from $0 all the way up to thousands of dollars. Quizlet is the easiest way to study, practise and master what you're learning. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. Create your own flashcards or choose from millions created by other students. Learn the differences and how they affect you today. The calculus for choosing your deductible is slightly different with these two insurance types than with health insurance. I just accepted a job offer at a large is this a low or high deductible? My dad has always had stellar insurance so i never had. In most cases, the deductible must be satisfied before the insurance company.

Your insurance deductible is the amount of money that you'll have to pay before the insurance company will provide any assistance. The video will help you understand the term deductible, why is deductible so important and how does deductible affect your travel insurance cost or. A deductible is a set amount you may be required to pay out of pocket before your plan begins to pay for as mentioned, the health insurance deductible may vary from plan to plan. An insurance deductible how much the policyholder pays before the insurance company starts to pay for a claim. A deductible is the amount you pay for health care services before your health insurance begins to pay.

Quizlet is the easiest way to study, practise and master what you're learning. Home insurance deductibles are usually quite different than other insurance deductibles. Some insurers make $1,000 the default choice, and as a result, many of their policies are written with a $1,000 deductible. We asked jeremy schlueter, a farmers insurance® agent in brecksville, ohio, for an explanation of auto insurance deductibles. In health insurance, a deductible is the amount that you as a policyholder must pay each year toward your medical expenses before the insurance company what is a deductible in regards to insurance coverage? When you make a claim, your insurance deductible is the amount you have to cover yourself before your insurance company will chip in. The video will help you understand the term deductible, why is deductible so important and how does deductible affect your travel insurance cost or. Once you've met this comprehensive deductible, your plan's coinsurance will take effect. After that, you share the cost with your plan by paying coinsurance. How does a health insurance deductible work? Deductibles are created to share the cost of care. How much can you save by raising your auto insurance a car insurance deductible is the amount you have to pay when you file an insurance claim with your carrier. An insurance deductible is the amount of money you, the policy holder, have to pay for services or benefits covered by your insurance policy before your insurance for example, you may have a car insurance plan that covers damage to your car, but your policy specifies an $800 deductible per claim.

An Insurance Deductible Is Quizlet: When you make a claim, your insurance deductible is the amount you have to cover yourself before your insurance company will chip in.

0 Tanggapan:

Post a Comment